Filter by

# Debug Box

/www/wwwroot/opac.peradaban.ac.id/lib/SearchEngine/DefaultEngine.php:610 "Search Engine Debug 🔎 🪲"

Engine Type ⚙️: "SLiMS\SearchEngine\DefaultEngine"

SQL ⚙️: array:2 [ "count" => "select count(distinct b.biblio_id) from biblio as b left join mst_publisher as mp on b.publisher_id=mp.publisher_id left join mst_place as mpl on b.publish_place_id=mpl.place_id where b.opac_hide=0 and (b.biblio_id in(select bt.biblio_id from biblio_topic as bt left join mst_topic as mt on bt.topic_id=mt.topic_id where mt.topic like ?))" "query" => "select b.biblio_id, b.title, b.image, b.isbn_issn, b.publish_year, mp.publisher_name as `publisher`, mpl.place_name as `publish_place`, b.labels, b.input_date, b.edition, b.collation, b.series_title, b.call_number from biblio as b left join mst_publisher as mp on b.publisher_id=mp.publisher_id left join mst_place as mpl on b.publish_place_id=mpl.place_id where b.opac_hide=0 and (b.biblio_id in(select bt.biblio_id from biblio_topic as bt left join mst_topic as mt on bt.topic_id=mt.topic_id where mt.topic like ?)) order by b.last_update desc limit 10 offset 20" ]

Bind Value ⚒️: array:1 [ 0 => "%Pajak%" ]

Pengaruh Aset pajak tengguhan, leverange dan kompensasi bonus terhadap manaje…

- Edition

- -

- ISBN/ISSN

- -

- Collation

- 21 cm x 29.5 cm.; i + 111 hlm

- Series Title

- -

- Call Number

- 330 PUJ p

- Edition

- -

- ISBN/ISSN

- -

- Collation

- 21 cm x 29.5 cm.; i + 111 hlm

- Series Title

- -

- Call Number

- 330 PUJ p

Tax Law Design And Drafting

Buku ini berisi tentang: 1. Tax Legislative Process 2. Legal Framework for Taxation 3. Drafting Tax Legislation 4. Law of Tax Administration and Procedure 5. Regulation of Tax Professionals 6. Value-Added Tax 7. VAT Treatment of Immovable Property 8. Excises 9. Tax on Land and Buildings 10. Taxation of Wealth 11. Social Security Taxation 12. Presumptive Taxation 13. Adjusting Taxes…

- Edition

- vol.1

- ISBN/ISSN

- 1-55775-586-6

- Collation

- +494 hlm.; 22,7 cm x 15 cm

- Series Title

- -

- Call Number

- 343.04 WAS a

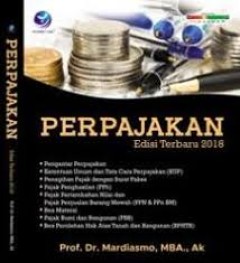

Perpajakan; Edisi Terbaru 2018

buku ini berisi tentang : 1. dasar-dasar perpajakan 2.ketentuan umum dan tata cara perpajakan 3. penagihan pajak 4. pajak penghasilan 5. pajak pertambahan nilai 6. bea materai

- Edition

- 2018

- ISBN/ISSN

- 978-979-29-6794-4

- Collation

- xvi+404 hlm.;19 cm x 23 cm

- Series Title

- -

- Call Number

- 336.2 MAR p

The Economics Of Tax Policy

buku ini berisi tentang : 1. optimal taxation as a guide to tax policy 2. taxation and saving 3. labour supply and taxation 4. the corporation tax 5. the welfare economics of tax coordination in the european community 6. taxation and the environment

- Edition

- Cet. 1

- ISBN/ISSN

- 0-19-877430-3 pbk

- Collation

- x + 259 hlm.; 14 x 21 cm

- Series Title

- -

- Call Number

- 336.2 DEV t

PERPAJAKAN Edisi Terbaru 2016

Buku ini berisi tentang : 1. pengantar -perpajakan 2. ketentuan umum dan tata cara perpajakan 3. penagihan pajak dengan surat paksa 4. pajak penghasilan 5. pajak pertambahan nilai barang dan jasa dna pajak penjualan atas barang mewah 6. BEA materai 7. pajak bumi dan bangunan 8. BEA perolehan hak atas tanah dan bangunan

- Edition

- -

- ISBN/ISSN

- 978-979-29-5324-4

- Collation

- xxx+426 hlm.; 19 x 23 cm

- Series Title

- -

- Call Number

- 336.2 MAR p

Analisis Pajak Daerah Dan Retribusi Daerah Terhadap Pendapatan Asli Daerah (P…

- Edition

- -

- ISBN/ISSN

- -

- Collation

- i + 109 hlm,; 21 cm x 29.5 cm

- Series Title

- -

- Call Number

- 330 SUS a

- Edition

- -

- ISBN/ISSN

- -

- Collation

- i + 109 hlm,; 21 cm x 29.5 cm

- Series Title

- -

- Call Number

- 330 SUS a

Perpajakan (Edisi Terbaru 2016)

Buku ini berisi tentang : 1. Pengantar Perpajakan 2. Ketentuan Umum Dan Tata Cara Perpajakan 3. Penagihan pajak dengan surat paksa 4. Pajak Penghasilan 5. Pajak Pertambahan Nilai barang dan jasa dan pajak penjualan atas barang mewah 6. Bea materai 7. Pajak Bumi dan bangunan 8. Bea perolehan hak atas tanah dan bangunan

- Edition

- Ed. XVIII

- ISBN/ISSN

- 978-979-29-5324-4

- Collation

- xxx + 426 hlm.; 19 x 23 cm

- Series Title

- -

- Call Number

- 336.2 MAR p

Analisis Faktor-Faktor Yang Berpengaruh Terhadap Kesadaran Kewajiban Perpajak…

- Edition

- -

- ISBN/ISSN

- -

- Collation

- 21,5 cm x 29,5 cm, xiv, 76 hal + lampiran

- Series Title

- -

- Call Number

- 330 WUL a

- Edition

- -

- ISBN/ISSN

- -

- Collation

- 21,5 cm x 29,5 cm, xiv, 76 hal + lampiran

- Series Title

- -

- Call Number

- 330 WUL a

Pengaruh Sosialisasi, Sanksi Dan Sikap Wajib Pajak Terhadap Kepatuhan Wajib P…

- Edition

- -

- ISBN/ISSN

- -

- Collation

- 21,5 cm x 29,5 cm, xiv, 129 halaman + lampiran

- Series Title

- -

- Call Number

- 330 KRI p

- Edition

- -

- ISBN/ISSN

- -

- Collation

- 21,5 cm x 29,5 cm, xiv, 129 halaman + lampiran

- Series Title

- -

- Call Number

- 330 KRI p

Pengaruh Pemahaman Peraturan Pajak Terhadap Kepatuhan Wajib Pajak Orang Priba…

Penelitian ini merupakan penelitian survei. metode analisis data dengan menggunakan uji interaksi karena terdapat variabel moderating. convenience sampling method digunakan dalam penentuan responden.

- Edition

- -

- ISBN/ISSN

- -

- Collation

- 21,5 cm x 29,5 cm, xi, 131hal + lampiran

- Series Title

- -

- Call Number

- 330 TAU p

Computer Science, Information & General Works

Computer Science, Information & General Works  Philosophy & Psychology

Philosophy & Psychology  Religion

Religion  Social Sciences

Social Sciences  Language

Language  Pure Science

Pure Science  Applied Sciences

Applied Sciences  Art & Recreation

Art & Recreation  Literature

Literature  History & Geography

History & Geography